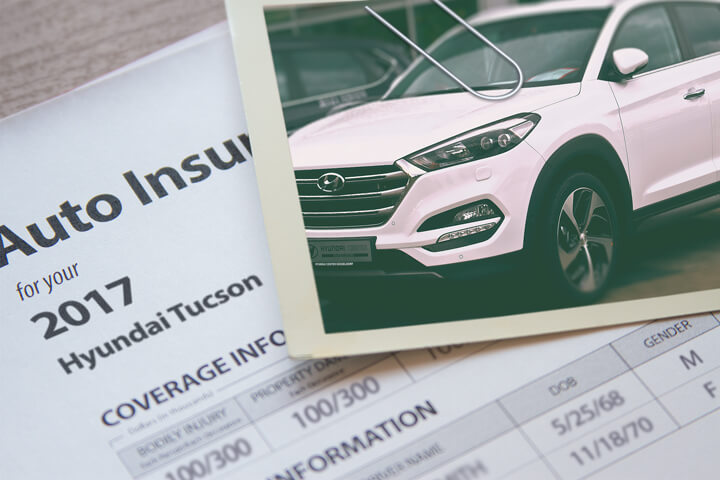

Hyundai Tucson insurance image courtesy of QuoteInspector.com

Wish you could get out of an expensive auto insurance policy? Trust us when we tell you many Santa Ana drivers feel the same as you.

It's safe to conclude that car insurance companies don't want you to look for cheaper rates. Insureds who get comparison quotes at least once a year will most likely switch companies because there is a significant possibility of finding a lower-priced company. A recent survey revealed that drivers who routinely shopped for cheaper coverage saved an average of $850 each year compared to policyholders who didn't regularly shop around.

It's safe to conclude that car insurance companies don't want you to look for cheaper rates. Insureds who get comparison quotes at least once a year will most likely switch companies because there is a significant possibility of finding a lower-priced company. A recent survey revealed that drivers who routinely shopped for cheaper coverage saved an average of $850 each year compared to policyholders who didn't regularly shop around.

If finding budget-friendly car insurance in Santa Ana is your goal, then having a grasp of the best way to compare coverage rates can help simplify the process.

Drivers have many insurance companies to choose from, and although it's a good thing to be able to choose, too many choices makes it more difficult to find a good deal for Hyundai Tucson insurance in Santa Ana.

Smart consumers take time to compare premium rates before your next renewal because prices change regularly. Despite the fact that you may have had the lowest price on Hyundai Tucson insurance in Santa Ana two years ago the chances are good that you can find a lower rate quote today. Forget all the misinformation about auto insurance because you're about to find out how to use the internet to reduce your cost while improving coverage.

We hope to tell you how car insurance works and also save some money in the process If you are already insured, you will be able to find better prices using this strategy. But California drivers do need to learn how the larger insurance companies calculate their prices because it can help you find the best coverage.

The majority of larger companies such as 21st Century, Allstate and State Farm give insurance quotes on their websites. Obtaining pricing for Hyundai Tucson insurance in Santa Ana is very simple as you just enter your required coverages into the form. Once you submit the form, their quoting system will order credit information and your driving record and provides a quote based on many factors. Being able to quote online for Hyundai Tucson insurance in Santa Ana makes it easy to compare insurance prices and it's very important to get many rate quotes in order to get lower-cost rates.

In order to find out how much you're overpaying now, take a look at the companies shown below. If you have coverage now, it's recommended you copy your coverages as shown on your current policy. This way, you will have a price comparison using the exact same coverages.

The companies shown below can provide free quotes in Santa Ana, CA. If more than one company is shown, we recommend you compare several of them to get the best price comparison.

Three main reasons to buy insurance

Even though Santa Ana Tucson insurance rates can get expensive, buying insurance is a good idea for several reasons.

First, just about all states have compulsory liability insurance requirements which means it is punishable by state law to not carry a specific minimum amount of liability protection if you don't want to risk a ticket. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

Second, if you have a loan on your car, most banks will make it a condition of the loan that you carry insurance to guarantee loan repayment. If coverage lapses or is canceled, the bank may buy a policy for your Hyundai at a significantly higher premium and force you to pay much more than you were paying before.

Third, insurance safeguards both your assets and your Hyundai Tucson. It also can pay for all forms of medical expenses for not only you but also any passengers injured in an accident. Liability coverage also covers all legal expenses up to the policy limit if you are sued as the result of an accident. If damage is caused by hail or an accident, collision and comprehensive (also known as other-than-collision) coverage will cover the repair costs.

The benefits of buying insurance are without a doubt worth the cost, especially if you ever need it. But the average American driver is overpaying more than $800 each year so shop around once a year at a minimum to make sure the price is not too high.

Hyundai Tucson detailed coverage information

The information displayed below covers a range of policy rates for Hyundai Tucson models. Having a better idea how prices are calculated can help customers make informed decisions when comparing rate quotes.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tucson GLS 2WD | $284 | $554 | $464 | $28 | $138 | $1,468 | $122 |

| Tucson GLS 4WD | $326 | $554 | $464 | $28 | $138 | $1,510 | $126 |

| Tucson Limited 2WD | $326 | $672 | $464 | $28 | $138 | $1,628 | $136 |

| Tucson Limited 4WD | $326 | $672 | $464 | $28 | $138 | $1,628 | $136 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes married female driver age 40, no speeding tickets, no at-fault accidents, $100 deductibles, and California minimum liability limits. Discounts applied include claim-free, safe-driver, multi-policy, homeowner, and multi-vehicle. Premium costs do not factor in vehicle location which can impact auto insurance rates noticeably.

Choosing deductibles

One of the more difficult decisions when buying car insurance is how high or low should comp and collision deductibles be. The comparisons below may help to conceptualize the costs and benefits when you select higher and lower comp and collision deductibles. The first data table uses a $250 physical damage coverage deductible and the second rate chart uses a $1,000 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tucson GLS 2WD | $298 | $472 | $442 | $26 | $132 | $1,395 | $116 |

| Tucson GLS 4WD | $342 | $472 | $442 | $26 | $132 | $1,439 | $120 |

| Tucson Limited 2WD | $342 | $576 | $442 | $26 | $132 | $1,543 | $129 |

| Tucson Limited 4WD | $342 | $576 | $442 | $26 | $132 | $1,543 | $129 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tucson GLS 2WD | $184 | $298 | $442 | $26 | $132 | $1,082 | $90 |

| Tucson GLS 4WD | $210 | $298 | $442 | $26 | $132 | $1,108 | $92 |

| Tucson Limited 2WD | $210 | $362 | $442 | $26 | $132 | $1,172 | $98 |

| Tucson Limited 4WD | $210 | $362 | $442 | $26 | $132 | $1,172 | $98 |

| Get Your Own Custom Quote Go | |||||||

Data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and California minimum liability limits. Discounts applied include safe-driver, homeowner, claim-free, multi-vehicle, and multi-policy. Prices do not factor in specific zip code location which can change coverage rates substantially.

Based on the figures above, using a $250 deductible will cost you approximately $29 more each month or $348 for a full year averaged for all Tucson models than choosing the higher $1,000 deductible. Due to the fact that you would have to pay $750 more to settle a claim with a $1,000 deductible as compared to a $250 deductible, if you usually have more than 26 months between claims, you would come out ahead by going with a higher deductible.

How to determine if a higher deductible is a good idea

| Average monthly premium for $250 deductibles: | $124 |

| Average monthly premium for $1,000 deductibles (subtract): | - $95 |

| Monthly savings from raising deductible: | $29 |

| Difference between deductibles ($1,000 - $250): | $750 |

| Divide difference by monthly savings: | $750 / $29 |

| Number of months required between physical damage coverage claims in order to save money by choosing the higher deductible | 26 months |

One important note is that higher deductibles results in having to pay to pay more out-of-pocket when you do file a claim. You need to make sure you have some extra savings in order to pay the deductible.

The example below demonstrates how choosing different deductibles and can influence Hyundai Tucson insurance rates for each age group. The information is based on a single female driver, comp and collision included, and no discounts are applied to the premium.

Hyundai Tucson insurance costs by gender and age in Santa Ana

The information below illustrates the comparison of Hyundai Tucson car insurance costs for male and female drivers. Data assumes no accidents, no driving violations, full coverage, $500 deductibles, single marital status, and no discounts are applied to the premium.

Cheaper Hyundai Tucson insurance in Santa Ana

Auto insurance is not an enjoyable expense, but there could be significant discounts that can dramatically reduce your bill. Larger premium reductions will be automatically applied when you complete an application, but some need to be requested specifically before you will receive the discount.

- First Accident Forgiveness - Not a discount per se, but certain companies will allow you to have one accident before hitting you with a surcharge with the catch being you have to be claim-free for a set time period.

- Data Collection Discounts - Insureds who allow data collection to study driving manner through the use of a telematics system such as Drivewise from Allstate or Snapshot from Progressive could possibly reduce rates if they exhibit good driving behavior.

- Air Bag Discount - Vehicles with factory air bags or motorized seat belts can get savings of 25 to 30%.

- Anti-lock Brake Discount - Cars and trucks with anti-lock braking systems can stop better under adverse conditions and qualify for as much as a 10% discount.

- Paperless Signup - A few larger online companies will give you a small discount for buying a policy and signing up over the internet.

- New Car Discount - Buying a new car model can get you a discount compared to insuring an older model.

- Service Members Pay Less - Being on active deployment in the military could trigger a small discount.

- Organization Discounts - Participating in a qualifying organization is a simple method to lower premiums on your bill.

- Payment Method - By paying your policy upfront as opposed to paying monthly you could save 5% or more.

Consumers should know that many deductions do not apply to the entire policy premium. The majority will only reduce specific coverage prices like comprehensive or collision. So despite the fact that it appears you can get free auto insurance, insurance companies wouldn't stay in business. But any discount will cut the premium cost.

The diagram below illustrates the comparison of Hyundai Tucson premium costs with and without policy discounts. The prices are based on a male driver, no violations or claims, California state minimum liability limits, full coverage, and $100 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-car, claim-free, safe-driver, multi-policy, marriage, and homeowner discounts applied.

A few popular companies and a partial list of their discounts are:

- Esurance offers discounts for good student, anti-theft, paid-in-full, safety device, and multi-policy.

- The Hartford discounts include air bag, good student, bundle, vehicle fuel type, driver training, defensive driver, and anti-theft.

- AAA may have discounts that include anti-theft, education and occupation, AAA membership discount, pay-in-full, good student, multi-policy, and good driver.

- GEICO offers discounts including military active duty, daytime running lights, multi-vehicle, air bags, and good student.

- State Farm has savings for accident-free, Steer Clear safe driver discount, Drive Safe & Save, multiple policy, student away at school, and driver's education.

If you want affordable Santa Ana car insurance quotes, ask all companies you are considering which discounts you may be entitled to. Some of the earlier mentioned discounts might not be offered in Santa Ana. To locate companies that offer many of these discounts in California, follow this link.